White Paper on China's Pet Industry in 2025

Time of issue:

Dec 16,2024

A Quick Review of White Paper on China's Pet Industry in 2025

1. The scale of urban (dog and cat) consumer market will exceed 300 billion in 2024

In 2024, the scale of urban (dog and cat) consumer market will increase by 7.5% to 300.2 billion yuan. Among them, the scale of dog consumer market will reach 155.7 billion yuan, a slight increase of 4.6%; the scale of cat consumer market will reach 144.5 billion yuan, an increase of 10.7%.

2. The number of pet dogs and cats in urban areas increased slightly, exceeding 120 million

In 2024, the number of pets will be 124.11 million, an increase of 2.1% over 2023. Among them, the number of pet dogs will be 52.58 million, an increase of 1.6% over 2023, and the number of pet cats will be 71.53 million, an increase of 2.5% over 2023.

3. The average annual consumption of pet owners shows a slight upward trend

The average annual consumption of a single pet dog is 2,961 yuan, an increase of 3.0% over 2023. The average annual consumption of a single pet cat is 2,020 yuan, an increase of 4.9% over 2023.

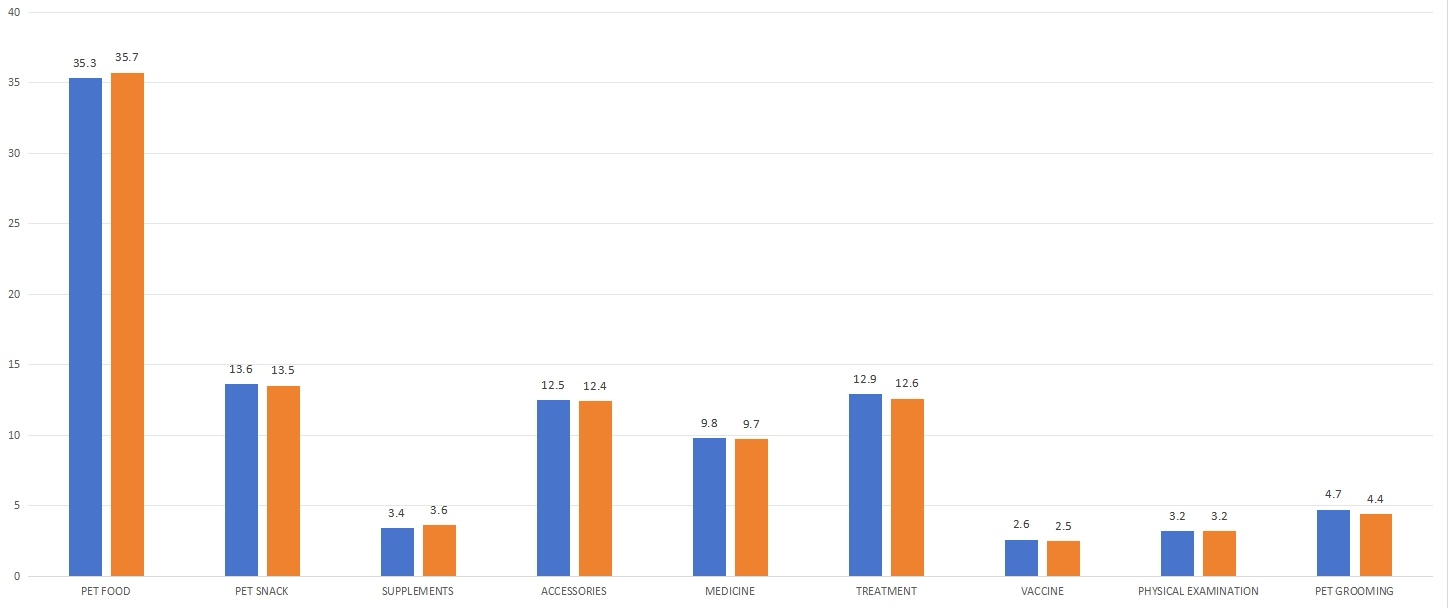

4. The pet market structure is stable, and the sub-markets fluctuate slightly

From the perspective of consumption structure, the food market will still be the main consumer market in 2024, with a market share of 52.8%. Staple food and nutritional products will increase slightly, while snacks will decrease slightly. The second largest market is the medical market, with a market share of 28.0%. Among them, vaccines and physical examinations are relatively stable, while medicines and diagnosis and treatment have declined slightly. Supplies and services have a lower market share, at 12.4% and 6.8% respectively, but there is room for growth.

5. The proportion of young pet owners continues to rise, while the proportion of elderly pet owners decreases.

Pet owners born after 1990 are still the main force of pet keeping, accounting for 41.2%, a decrease of 5.4 percentage points from 2023. Pet owners born after 2000 continue to rise, accounting for 25.6%, an increase of 15.5 percentage points from 2023. Pet owners born after 1980 account for 26.5%, an increase of 10.8 percentage points. The proportion of pet owners born after 1970 and before 1970 continues to decline, among which those born after 1970 decreased by 2.8 percentage points, and those before 1970 decreased by 2.7 percentage points.

Pet owners' consumption view: In 2024, has pet owners' consumption really been downgraded?

1. Looking at 2024, pet owners have good consumption power.

The survey shows that 31.4% of pet owners believe that their consumption habits have changed significantly after the epidemic, 39.2% of pet owners believe that their consumption habits have changed somewhat after the epidemic, and 26.4% of pet owners believe that there has been no change. Among them, 37.2% of pet owners believe that their consumption expenditure has increased slightly, 28.1% of pet owners believe that their consumption expenditure has remained basically unchanged, 18.8% of pet owners believe that their consumption expenditure has increased significantly, and 13.7% of pet owners choose a slight decrease in consumption expenditure.

2. Pet owners tend to buy high-quality and practical products

Among the pet owners surveyed, 32.2% of them only consider practical products, 23.9% of them say that practicality and value are more important than popularity, 17.2% of them say that quality is more important than brand, 15.5% of them only consider high-quality products, 14.2% of them only buy popular products, 13.1% of them only buy branded products, and 11.2% of them only buy products that meet basic needs and are cost-effective.

Pet food market: Growth slows down, is it difficult for the pet food market to break through?

1. Refined pet care continues to improve, and freeze-dried and baked food are still "hot categories"

In 2024, dog owners' preference for baked food, freeze-dried food, and fresh food will increase. Among them, baked food and wet food have increased significantly. Cat owners' preference for baked food and fresh food has increased, while their preference for freeze-dried food and puffed food has decreased.

2. Staple foods with functional ingredients and high nutritional value are more likely to trigger pet owners to buy

Nutritional ratio, ingredient composition, and brand awareness are still the most important decision-making factors for pet owners, accounting for 59.3%, 49.2%, and 29.0% respectively. Compared with 2023, pet owners pay more attention to palatability, user reputation/purchase evaluation, traceability of ingredients, and specific special functions, accounting for 25.0%, 24.6%, 15.2%, and 14.7% respectively.

3. Pet owners' "hoarding habits" gradually shift to "high-frequency purchases"

Among pet owners who are used to buying staple food periodically, 1-3 months is the most common purchase cycle, and there is a continuous upward trend. Among them, 81.4% of dog owners buy staple food in 1-3 months, and 81.1% of cat owners buy staple food in 1-3 months

4. The preference for domestic staple food brands continues to rise

Among dog owners: 43.5% of dog owners have no clear brand preference, 32.9% of dog owners only buy Chinese brands, and 13.5% of dog owners only buy foreign brands. Among cat owners: 44.4% of cat owners have no clear brand preference, 34.8% of cat owners only buy Chinese brands, and 12.8% of cat owners only buy foreign brands. Overall, pet owners' preference for Chinese brands has increased significantly, while their preference for foreign brands has decreased.

Pet products market: There are a variety of products, but are they really competitive enough?

1. The penetration rate of cat products has rebounded, while the penetration rate of dog products has "decreased more than increased"

Among dog products, the penetration rates of pet clothing, disinfection and deodorization products, and smart products have increased slightly compared with 2023, with penetration rates of 63.5%, 49.7%, and 17.5%, respectively, while other categories have declined to varying degrees. Among cat products, pet toys and cage backpacks have decreased slightly compared with 2023, while other products have increased. Among them, the penetration rates of pet products and pet clothing have increased significantly, at 43.4% and 19.2%, respectively.

2. There are many types of cat litter, and the preference for mixed cat litter and bentonite cat litter has increased

Compared with 2023, the preference for mixed cat litter and bentonite cat litter has increased significantly. Among them, mixed cat litter increased by 8.3 percentage points. Bentonite cat litter increased by 3.6 percentage points. Pet owners' preference for tofu cat litter has decreased, down 7.3 percentage points.

3. The smart products market is recovering, and preferences are generally rising

Compared with 2023, the preference for smart products has rebounded. Except for a slight decline in the preference for smart cameras, other categories have increased. Among them, smart feeders and smart training products have increased significantly.

4. Pet owners pay more attention to the material, reputation, and cost-effectiveness of products

In terms of categories, pet owners pay more attention to the water absorption of clumping, material, cost-effectiveness, and user reputation when choosing cat litter. When choosing toys, they pay more attention to the safety of product materials, durability, cost-effectiveness, and novel product design. When choosing smart products, they pay more attention to the difficulty of operation, cost-effectiveness, and user reputation.

Leave Message

We will contact you within one working day. Please pay attention to your email.

Quick Link

Contact Us

Factory: Jia Song town, Nanhe District, Xing Tai City, Hebei Province

Whatsapp: +85284112581

Tel: +86-17360164690

E-mail: sales@doukecatlitter.com

E-mail: doukehoulijing@gmail.com